Why I don’t like technical analysis – and why it doesn’t work

If the patterns we see were reliable enough and would work as often as they are presented, all you would need is a 10-minute tutorial and plug the algorithm in to your broker

People like to be in control of things and we try to find patterns in life that make things easier.

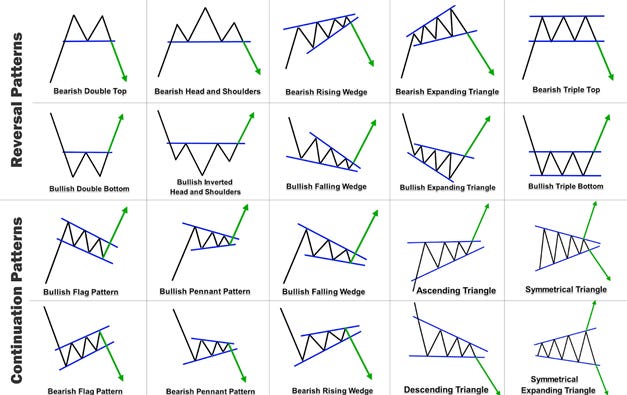

In the trading community there is this concept of technical analysis used and taught by retail traders. Technical analysis is the analysis of a chart using special patterns and formations. (Put that one for my beginners out there)

Essentially, anyone who is familiar enough with trading will laugh at the concept of drawing triangles and will soon realize that it can not be that simple.

But traders and institutions apply technical analysis in their personal trading. So what is there to take?

I’m very convinced that you must have seen this picture at least once, a list of chart patterns.

Chart patterns are usually what the average beginner will come across and will believe that this is all that there is to technical analysis. However, no one who has memorized candle stick patterns or chart patterns has achieved profitability.

Strategies based on chart patterns will underperform, the average trader would switch the strategy he or she is using just after two days of underperformance, so why should we believe this is something that will work in the long run? It’s not that the patterns don’t happen that often but the fact that they are simply not that consistent. What happens when the pattern actually works and you enter the trade and it goes your way What then? I’m convinced you’re not sure what happens then. When do I exit? Where does my stop loss go? Yeah… It’s not all in the patterns. Technical analysis simply doesn’t work because of it not being consistent. Obviously, if that were the case, trading would be way easier, and the systems we present would be able to be automated. That’s also why I believe that the only way how to obtain an edge is by incorporating discretion.

But we know that institutions use patterns and technical data. How come it works for them? Well, we need to take in to consideration that most trading now a day is done by automated systems and computers. So trading just solely with patterns and data is certainly possible. These institutions have scientifically proven methods of profitability. In other words, the people working at those institutions have computer science and math degrees, whereas you, the retail traders are drawing triangles.

*Price action vs technical analysis

However, not all technical analysis is bad, let’s just get the definitions out of the way for the newcomers…

Price action is the movement of a security's price plotted over time

Technical analysis is the study of historical market data, including price and volume

Price action is the bread and butter for traders, in fact, everyone before you who is a profitable trader already knows everything there is to price action. They traded longer then you, they are smarter and they definitely have more money.

If you want to be at least remotely good at trading I think this is something you should definitely look into.

So how does one master price action?

Knowing price action when trading is a skill

• Like any skill, you need to develop it, like being good at a video game, playing a musical instrument, speaking a language

• Any skill is largely based on implicit learning, so is learning price action

• There is no way to bypass a skill, the only way to achieve it is through TIME and DEDICATION

• A lot of chart time.

• There is no proper way of learning price action, everyone has their own journey.

• No formula is required, no pattern is needed. Not every pattern has to be the same, not every pattern has to be valid. Remember that.

• Master price action by every candle. Learn what the market is saying…

Am I seeing rejections, pullbacks, breakouts, reversals etc. Try to figure out these concepts…

One can argue that price action is the grand father of technical analysis, and that price action IS technical analysis in a certain way. They are not wrong.

They trick us into thinking what’s going to happen next based on what we have seen before. Learn how to trade properly. And for the love of god, please don’t rely on technical analysis.

Hi there, my name is Markus! I’m a day trader with a discretionary trading approach and I want to build my own trading community. It doesn’t matter how long, how good or what you trade! I think that you will find at least one thing that is helpful to you!